Better.com plots IPO after $4B valuation, more co-working losses

Better.com plots IPO after $4B valuation, more co-working losses

Trending

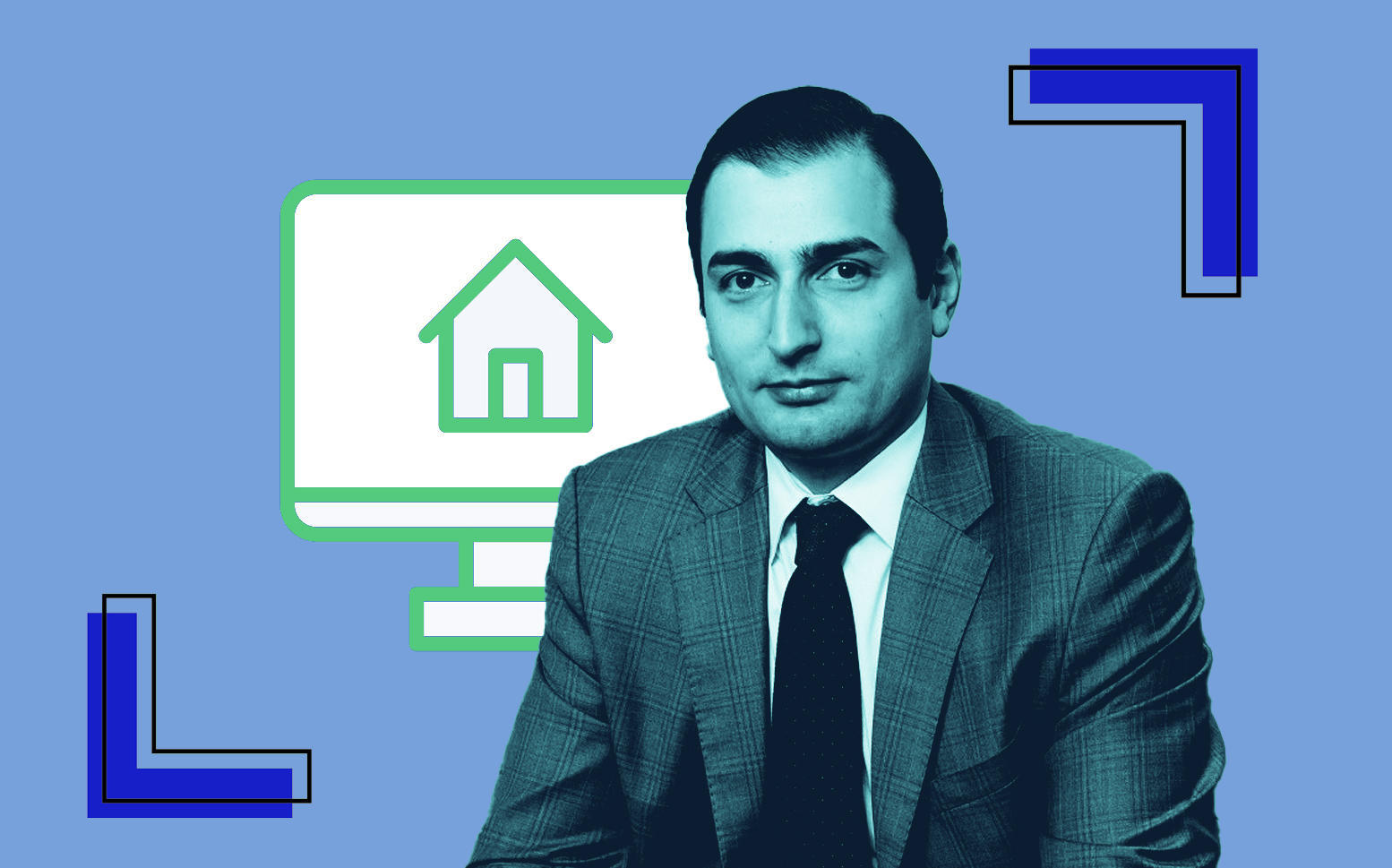

NYC attorney launches virtual closing startup

Sellers pay flat $350 fee on InstaClosing

Real estate attorney Peter Zinkovetsky has attended thousands of closings over the past decade. But, convinced there is a better way to finalize deals, he’s now launching a startup that makes the process virtual.

His company, InstaClosing, bills itself as an alternative to laborious, document-heavy closings that are currently the norm in residential real estate. Its services are being marketed directly to consumers, with a flat fee of $350 per closing. Typically, buyers and sellers pay several thousand dollars each.

“You go for something as simple as the transfer of title for the property, and all of a sudden you’re back in the 1970s,” said Zinkovetsky, who runs his own private law practice. “The only piece of technology being used at the closing was a copier.”

Since the onset of the pandemic, he added, in-person closings are also a “borderline health hazard.”

Zinkovetsky said he began working on the concept for InstaClosing three years ago. The company uses AI and an automated, 23-step due diligence process, which allows it to execute closings at a lower cost. When InstaClosing is hired by a seller, it conducts due diligence prior to any seller making an offer; that expedites the whole process. The firm stands by its inspections by currently offering a $30,000 post-closing property condition guarantee.

Read more

Better.com plots IPO after $4B valuation, more co-working losses

Better.com plots IPO after $4B valuation, more co-working losses

States Title raises $123M to digitize title, mortgage and escrow

States Title raises $123M to digitize title, mortgage and escrow

Ex-Zillow execs launch digital mortgage startup with $40M seed round

Ex-Zillow execs launch digital mortgage startup with $40M seed round

Zinkovetsky said ultimately InstaClosing will sell ads on the platform for an additional revenue stream, but right now he’s focused on proving the product works.

Over the past few months, demand for digital transactions has surged.

Last week, online lender Better.com raised $200 million at a $4 billion valuation and the company is rumored to be eyeing an IPO sometime next year.

Startups like States Title and Spruce have raised hundreds of millions of dollars from investors to digitize the title industry. And on the mortgage front, two former Zillow executives raised $40 million last month to launch Tomo, a fintech startup looking to streamline mortgages and real estate transactions. This past summer, Notarize raised $35 million after experiencing a 400 percent increase in demand for digital notarizations.

Zinkovestsky acknowledged that InstaClosing is not ideal for complex transactions, including estate sales, litigation or foreclosures.

“InstaClosing is not a law firm — it cannot provide legal advice,” he said. “But we can work with attorneys. It doesn’t have to be a substitute; it can be an add-on.”